The Yen continues its decline against the Dollar and Euro, dipping well below 100 Yen/Dollar en route to a six-month low. Most analysts attribute this trend to a pickup in risk aversion: “Some kind of optimism is returning to the market and that’s putting pressure on the yen,” explained one analyst succinctly.

An ongoing rally in stocks and commodities is reinforcing investor attitudes that the economic recession is under control, and is stimulating risk-taking. In other words, the same forces that contributed to the unwinding of the carry trade during the beginning of the credit crisis, are now working in reverse and causing investors to flee from the Yen en masse. “As long as stocks can retain their buoyancy… risk appetite and risk-based trades will be in vogue and investors will continue to add to and rebuild yen short positions.”

According to the most recent International Monetary Market report, “Short positions on the currency have been building up for three consecutive weeks, and are now at levels last seen in the late summer of 2008,” which means the Yen’s slide has basically become self-fulfilling. From a technical standpoint, “A move above 101.00 yen was technically significant as it was a 38.2 percent Fibonacci retracement of its decline from a peak in 2007 to its 13-year low in January.” Even domestic Japanese investors have signaled their bearishness by taking advantage of last week’s Yen upswing by making “aggressive purchases of foreign bonds.”

From a fundamental standpoint, the decline in the Yen makes sense, given the abysmal economic situation in Japan. In fact, the “Minutes from the Bank of Japan’s March meeting showed members of the central bank were leaning toward cutting the bank’s economic forecast in April, and that they believed the BOJ would need to continue to provide substantial liquidity to financial markets that they see as still under substantial stress.”

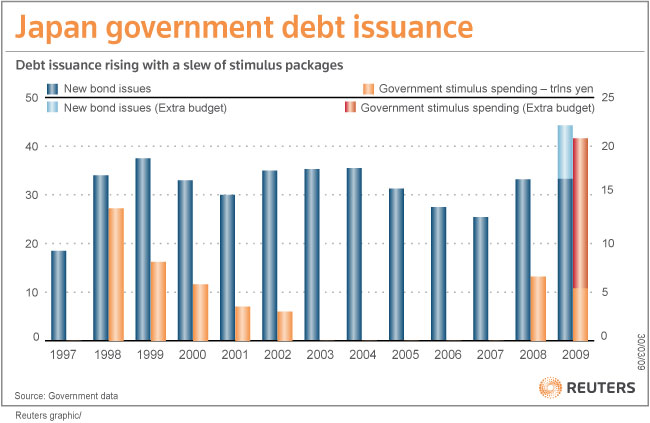

The government is finally responding to the economic crisis, having most recently unveiled a $150 Billion plan, to supplement the $100 Billion initiative announced earlier this year. “If implemented competently, these steps could stabilize the domestic economy and stop the bleeding in labor markets.” At the same time, the intertwined tailspin in confidence and spending suggest that the government’s efforts could be in vain.

While equity investors have reacted positively - pushing the stock market into positive territory for the year- bond and currency traders are understandably concerned. Yields on Japanese bonds are already rising in anticipation of $100 Billion in bonds that the government will have to issue in 2009 alone. Naturally, the burden to purchase these bonds will fall on the Bank of Japan, which will be forced to print money and contribute to the further devaluation of the Yen in the process.

Ultimately, the duration of the Yen’s slide depends on the duration of the global stock market rally. If you believe that the global economy has turned a corner, then the Yen is done. If, on the other hand, you are inclined to side with George Soros, who opined recently that “It’s a bear-market rally because we have not yet turned the economy around,” then there is still cause for Yen bullishness.

No comments:

Post a Comment